Take Advantage of New Tax Advantages with Your Fleet Vehicle Purchase

Section 168(k) - Temporary 100% Expensing

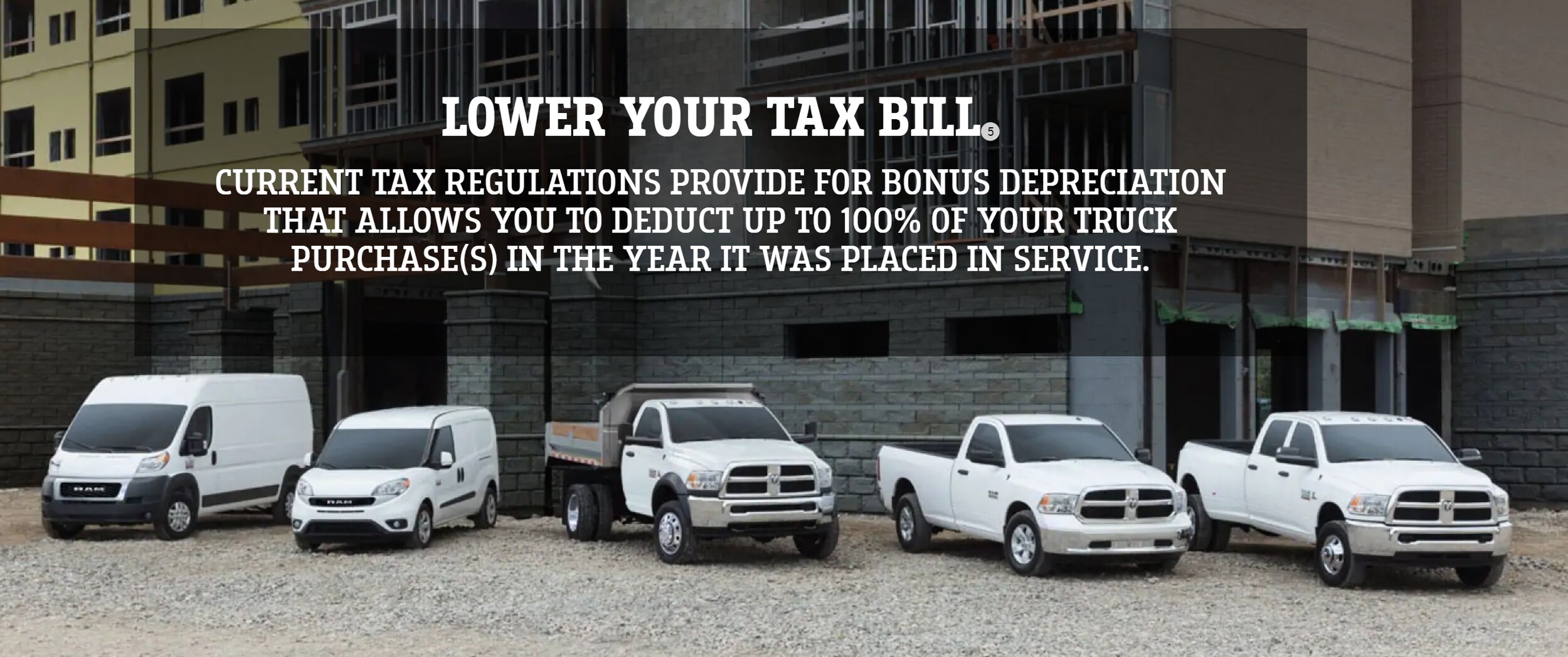

A Ram truck is generally considered qualified property for purposes of section 168(k) for U.S. Federal Income Tax purposes. This means a taxpayer may elect to treat the cost of any qualified property as an expense allowed as a deduction for the taxable year in which the property is acquired and placed in service.

Section 179 - First Year Expensing

A Ram truck is generally considered Section 179 property for U.S. Federal Income Tax purposes. This means a taxpayer may elect to treat the cost of any Section 179 property as an expense and allowed as a deduction for the taxable year in which the property is acquired and placed in service. A qualifying business may expense up to $1,000,000 of Section 179 property during 2018.

Find RAM Fleet Vehicles at Zeigler Dodge Chrysler Jeep RAM

Interested in taking advantage of this tax break and in search of a fleet vehicle dealership? If you live in the greater Downers Grove area, Zeigler is standing by to serve all of your fleet vehicle needs.

Make an Inquiry

* Indicates a required field

Hours

- Monday 09:00AM - 08:00PM

- Tuesday 09:00AM - 08:00PM

- Wednesday 09:00AM - 08:00PM

- Thursday 09:00AM - 08:00PM

- Friday 09:00AM - 07:00PM

- Saturday 09:00AM - 06:00PM

- Sunday Closed

Contact

Zeigler Chrysler Dodge Jeep Ram of Downers Grove

2311 Ogden Ave

Downers Grove, IL 60515-1769

- Sales: 630-427-4514

- Service: 630-241-5500

- Parts: 630-442-1716